April 23, 2024

Navigating your 30s as a single professional can be both an exciting journey and a unique challenge. Unlike your 20s, where the focus might have been on exploration and finding your footing, your 3...

Articles

April 18, 2024

Welcome to the exciting realm of tech stocks, where the promise of innovation meets the thrill of investment! If you are new to this world, you might feel like you are navigating a vast, uncharted ...

April 16, 2024

In today's swirl of financial choices, picking the perfect credit card might seem like finding a needle in a haystack. But what if I told you that with the right information and a sprinkle of savvy...

April 11, 2024

Everyone dreams of living a high-quality lifestyle—enjoying the finer things in life, traveling to exotic places, dining at the best restaurants, and wearing the latest fashion. However, achieving ...

April 9, 2024

In the bustling heart of The Woodlands, Texas, a unique financial institution stands apart from the rest. Here at TDECU - Texas Dow Employees Credit Union - we are more than just a credit union; we...

April 4, 2024

In today’s fast-paced world, finding a financial institution that not only meets your banking needs but also treats you like family can feel like searching for a needle in a haystack. However, nest...

April 2, 2024

Our website team will frequently write too much content for the page to handle. Rather than making you scroll through walls of text you may not need, we've included it here. Any questions? Contact ...

March 28, 2024

Discover key strategies for teachers to achieve financial wellness.

March 26, 2024

In the bustling city of Houston, finding a financial institution that feels like home can be daunting. However, nestled within the vibrant community of Houston Heights, TDECU stands out as a beacon...

March 21, 2024

In the heart of Houston, nestled within the vibrant surroundings of Champion Forest, lies a gem that redefines the essence of banking - TDECU Champion Forest. This is not just any credit union; it ...

March 19, 2024

Finding the right place to manage your finances can be like searching for a needle in a haystack. But what if I told you that your search ends today?

March 14, 2024

At TDECU, community involvement is not just a duty; it is a core part of our identity. Our commitment to fostering positive change manifests through various initiatives to uplift the communities we...

March 12, 2024

When it comes to personal finance, understanding the basics of personal loans is crucial. Personal loans can be a powerful tool in managing your financial landscape, whether for consolidating debt,...

March 8, 2024

On an early December morning, more than a dozen TDECU volunteers traded their usual routines for wrenches and wheels.

March 7, 2024

Congratulations to the TDECU Communications team on winning another prestigious award, marking a significant achievement in our ongoing journey of excellence. The International Association of Busin...

March 5, 2024

The spirit of the holiday season was alive and well at the 14th annual Operation Santa event, thanks to the combined efforts of TDECU and Combined Arms.

February 29, 2024

Our website team will frequently write too much content for the page to handle. Rather than making you scroll through walls of text you may not need, we've included it here. Any questions? Contact ...

February 27, 2024

In life's unpredictable journey, emergency funds act as a safety umbrella, shielding us from financial downpours.

February 22, 2024

Credit card debt can feel like a labyrinth, especially for young adults beginning their financial journey.

February 20, 2024

In today’s fast-paced world, finding a financial institution that meets your banking needs and exceeds expectations with great service can feel like a treasure hunt. Fortunately, for those in the C...

February 15, 2024

Welcome to TDECU's guide to transforming your wedding into a uniquely personal celebration with the magic of Etsy. Here, we will delve into the world of Etsy wedding planning, offering insight into...

February 13, 2024

Welcome to TDECU's comprehensive guide on savings accounts! Embark on a journey of financial discovery and empowerment with this essential guide.

February 8, 2024

Welcome to a journey that will set the course for your financial future. When choosing a banking institution, the stakes are high, especially for young families striving for financial stability and...

February 6, 2024

Welcome to TDECU's blog, where we demystify banking! Today, we are diving into the essentials of investing, offering you a roadmap to make informed financial decisions.

February 1, 2024

Welcome to our in-depth guide on car loans! At TDECU, we understand that purchasing a vehicle is a significant milestone. However, it is a path often riddled with confusion and uncertainty.

January 30, 2024

Imagine strolling through rows of vibrant, fresh produce, the air filled with the scent of ripe fruits and earthy vegetables. This is the essence of farmers markets, where the connection between la...

January 25, 2024

Welcome to Urban Oasis: Mastering the Art of City Gardening, a guide brought to you by TDECU. This blog post is designed to provide gardening tips for city dwellers, helping you transform your urba...

January 24, 2024

Welcome to the world of blissful and budget-friendly honeymoons! Embarking on a journey of love does not mean you have to exhaust your savings.

January 18, 2024

Welcome to Hidden Gems: Honeymoon Havens Near Houston! In this guide, we uncover the most romantic and enchanting local honeymoon destinations around Houston without having to break the bank flying...

January 16, 2024

When planning your dream wedding, creating a beautiful ambiance is crucial. However, it should not mean emptying your savings. TDECU presents a comprehensive guide to DIY Wedding Décor Ideas: Budge...

January 11, 2024

Weddings symbolize love and commitment but do not need to break the bank. Planning a budget-friendly wedding is not about compromising; it is about making smart choices to ensure a memorable day wi...

January 4, 2024

Purchasing a car is a significant financial decision that requires careful consideration, especially when working within a budget. To ensure you get the best value for your money, here are ten valu...

January 2, 2024

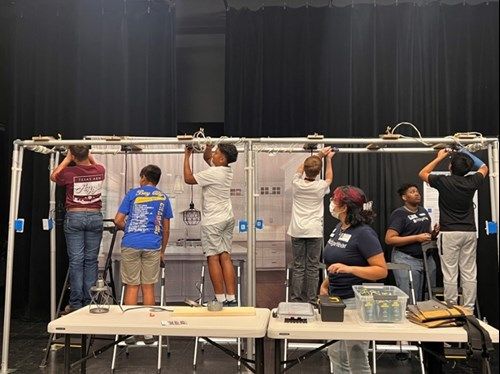

TDECU’s proud sponsorship of BridgeYear’s Career Test Drive at Bay City Junior High School with a $15,000 donation showcases its commitment to empowering students with real-world career experiences.

December 28, 2023

Volunteering is a rewarding journey, and TDECU’s September and October initiatives have exemplified that spirit.

December 27, 2023

In a dedicated effort to nurture not only athletic prowess but also financial acumen, TDECU embarked on a mission to educate and empower University of Houston student-athletes. Through its Financia...

December 26, 2023

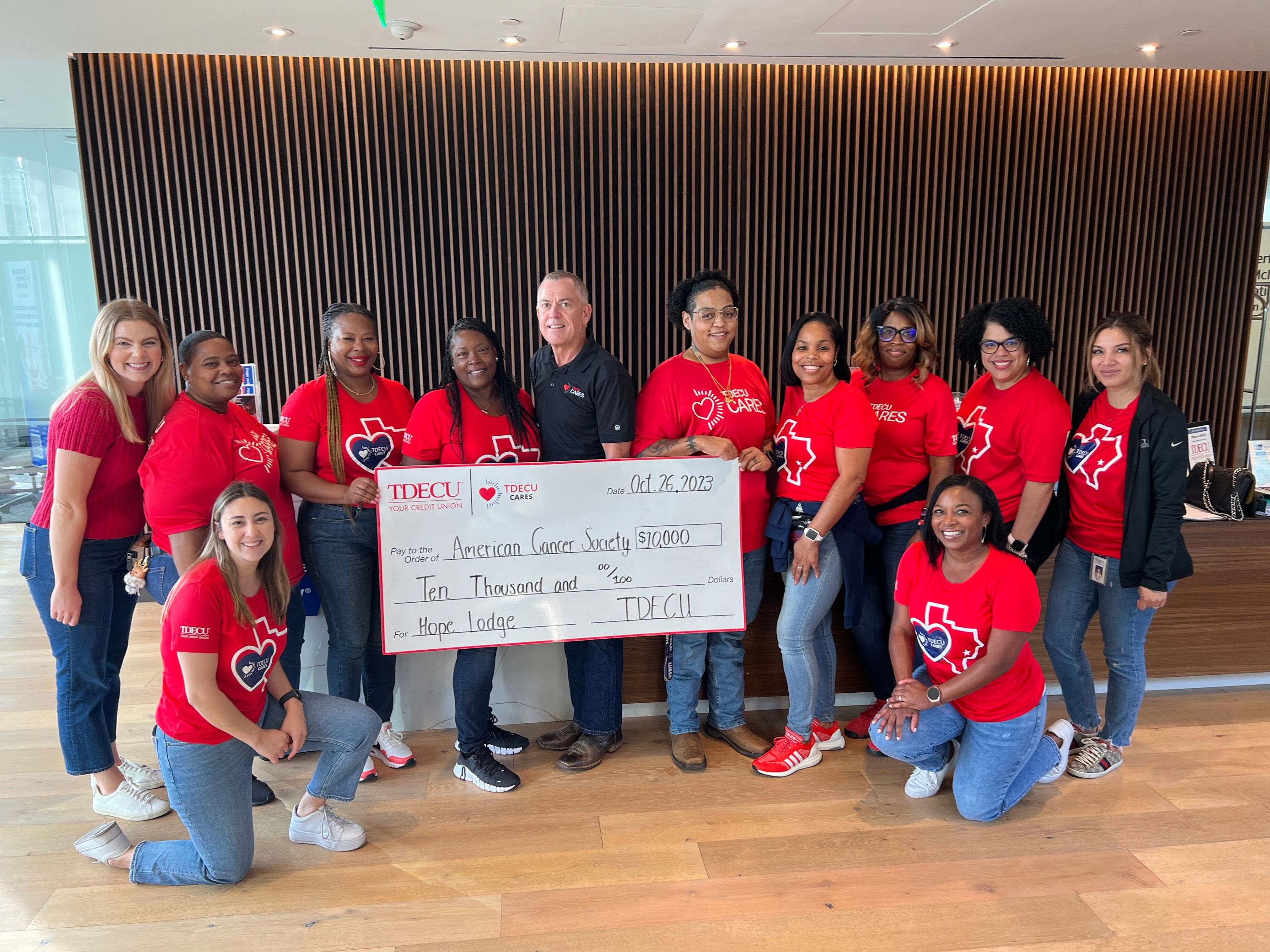

In today’s fast-paced world, community support cannot be overstated. TDECU recently extended its hands to support the American Cancer Society’s Hope Lodge, reflecting its commitment to fostering po...

December 19, 2023

In a demonstration of its commitment to education and the community, TDECU recently extended its support to DeLeon Elementary School in Victoria. Earlier this year, TDECU provided an $11,280 grant ...

December 14, 2023

On Saturday, October 28th, the Sleep in Heavenly Peace-Montgomery County, TX Chapter and TDECU exemplified its commitment by delivering 78 beds to children across the county. This altruistic act ho...

November 21, 2023

In the heart of Brazoria County, TDECU stands as a beacon of community support and unwavering dedication. This year, TDECU proudly accepts the prestigious President’s Volunteer Service Award from J...

November 16, 2023

Welcome to TDECU’s comprehensive guide on navigating winter conditions. As insurance experts, we understand individuals’ challenges and hazards during winter. In this blog, we will provide valuable...

November 6, 2023

Holiday shopping presents so many opportunities to add joy to the season. However, with those opportunities also comes the threat of compromised accounts. We've moved well beyond simply remembering...